Not known Details About Honda Of Bellingham

Table of ContentsThe Single Strategy To Use For Honda Of BellinghamWhat Does Honda Of Bellingham Mean?The Best Guide To Honda Of BellinghamThe Main Principles Of Honda Of Bellingham 5 Easy Facts About Honda Of Bellingham Explained

It's More Than Discovering the Right Vehicle. By going shopping around at dealerships and among personal sellers for the automobile they like the a lot of. On standard, over 60% of car purchasers finance or lease their brand-new or previously owned auto, lots of automobile buyers believe regarding where to fund as a second thought.So they shop and get pre-approved for funding prior to going shopping for an automobile. A lorry is the second most expensive purchase that lots of people make (after a home), so the settlement and rate of interest matter. You may be munching at the little bit to test drive that Roadster, we urge you to explore your auto funding choices initially.

They have some things in usual, but comprehending their differences will certainly assist you get right into the new or previously owned auto that ideal fits your requirements. It's appealing to finance your new automobile right at the car dealership.

The smart Trick of Honda Of Bellingham That Nobody is Talking About

Furthermore, if you enter into warm water with your finance and miss a payment or 2, you may locate yourself handling a lending institution halfway across the nation who has no direct connection with you and is not inclined to be as suiting as various other local banks. And yes, the supplier would certainly choose you maintain paying the funding so that they continue to make cash off the interest you are paying, however if you can not, they repossess the lorry, recoup their losses, and carry on, with little to no concern for the consumer.

Some automakers also have their very own borrowing services, like Ford Motor Credit Report and Toyota Financial Providers. These promos could consist of very low rate of interest perhaps even 0% or attractive cashback deals. Keep in mind, nevertheless, that these deals are normally just offered on all new autos and to clients with squeaky tidy credit report.

Considering that they know you and have a connection with you, they might be willing and able to provide you a reduced rates of interest than a dealership. The bank may even use incentives to financing with them if you do all your financial under their roof covering. When financing an auto through a bank, you have the advantage of looking around at numerous institutions to get an affordable deal or terms that best align with your spending plan and credit history profile.

Facts About Honda Of Bellingham Revealed

An additional vital pro to funding via a financial institution is that you will avoid surprises. Financial institutions will certainly look at your whole picture initially, and after that put with each other a lending program that fits your requirements which they are certain you can translucent payoff. When that remains in place, visit this site you are armed with the best information you require before selecting the ideal car for you.

Nonetheless, the big disadvantage for getting your funding with a financial institution is that the rate of interest they use are commonly greater than the nationwide average. Huge, nationwide banks often tend to run 10-percent above average and regional financial institutions run 24-percent over average, while credit history unions normally use rates 19-percent below the national average.

Although a traditional bank can be a superb option for funding your new wheels, you might be in much better hands at a local credit scores union. Banks are in business of making money for the investors at the top, which can equate right into interest rates that are not as affordable as those at a cooperative credit union, where the member is additionally an owner.

5 Easy Facts About Honda Of Bellingham Described

A credit history union is open to making changes and tweaks to the car loan product to establish you up for success. Credit unions are also recognized for their premium participant service.

They work hard to inform their members by providing excellent resources to help you recognize your financial resources, as well as their items and services. Once more, when you, the participant, are stronger, the cooperative credit union is more powerful. If you are currently a lending institution member, or you are attracted to the individual touch and extensive education they provide, you are sure to locate an excellent loan program there for your lorry purchase.

What make and model would you really such as? If you're willing to be versatile among a few similar alternatives, that helps your possibilities of getting the best deal.

Not known Facts About Honda Of Bellingham

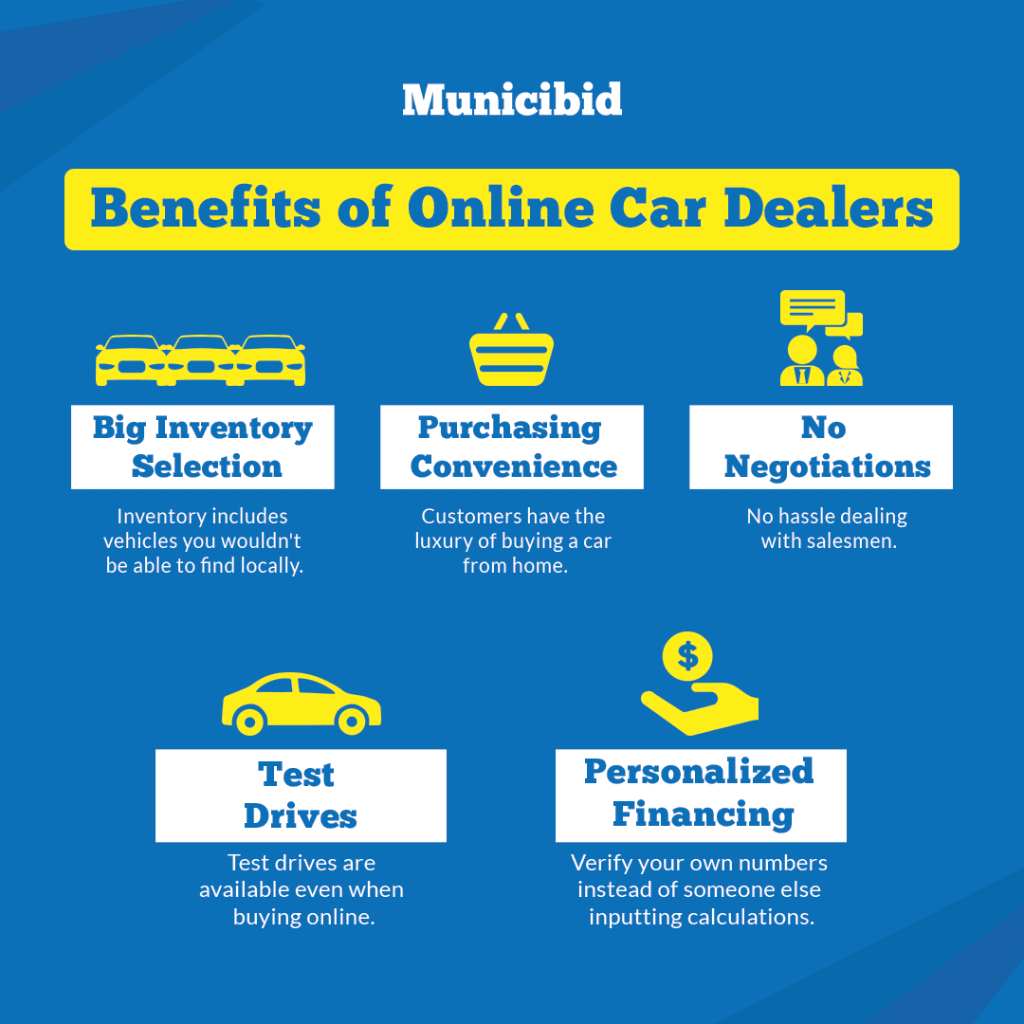

When it involves acquiring an automobile, among the initial choices you need to make is whether to purchase from a vehicle dealership or an exclusive vendor. Both options have their own set of advantages and drawbacks, and comprehending them can substantially influence your car-buying experience. While vehicle dealerships provide a vast option of cars and professional services, exclusive sellers often supply a much more customized method and potentially lower prices.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Scott Baio Then & Now!

Scott Baio Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!